PUBLISHED : 9 Jan 2025 at 06:02

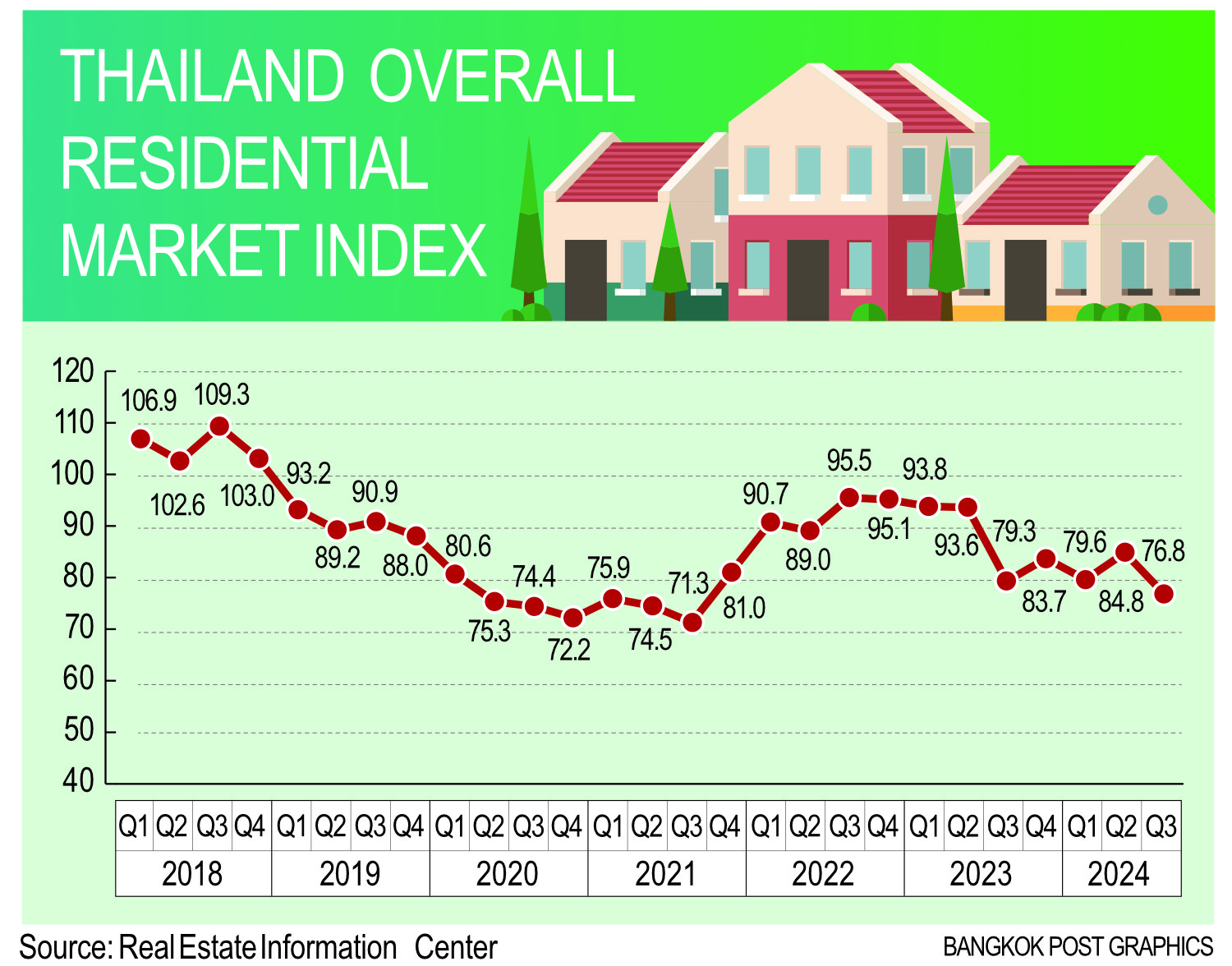

The overall residential market index in the third quarter of 2024 dropped to its lowest level in 12 quarters, dating back to the third quarter of 2021, driven by declining housing transfers and a slowdown in supply.

The Real Estate Information Center (REIC) reported the index was 76.8 for the third quarter, down from 84.8 in the second quarter of 2024 and 79.3 in the third quarter of 2023, as market activity decreased.

The index reached its lowest point since the third quarter of 2021, when it tallied 71.3.

Excluding the pandemic period from the second quarter of 2020 to the third quarter of 2021, this was the lowest level on record.

The index reflects the overall state of the residential market, covering both supply and demand. The decline was attributed to dips in both housing supply and demand.

On the demand side, residential ownership transfers fell 3% year-on-year. On the supply side, developers delayed launching new projects in locations plagued by weak demand.

Developers shifted focus to residential units priced less than 7 million baht as buyers sought more affordable options.

REIC forecasts the index will tally 82.1 in the final quarter of 2024, a 6.3% decline from the fourth quarter of 2023, despite improving economic conditions.

Thai economic growth in the third quarter of 2024 was 3%, beating the 1.6% and 2.2% posted in the first and second quarters, respectively.

The housing purchase confidence index for Greater Bangkok, which reflects consumer confidence, rose to 40.5 in the third quarter of 2024 from 39.6 in the second quarter.

Despite remaining below the neutral level of 50, the uptick signalled growing consumer optimism, driven by the government’s property measures and the recovering economy, according to the REIC.

Demographic data revealed women had greater confidence in home purchases (54.3%) than men. Prospective purchasers aged 25-34 accounted for the largest share, representing 46.9% of those interested in home purchases.

Among would-be buyers, 32.5% planned to purchase a property for a personal residence, while 17.5% aimed to buy for investment, indicating positive sentiment towards real estate as an asset class.

Regarding property preferences, 56.3% were interested in both new and secondhand homes. The share of prospective buyers seeking only new homes dropped from 37.2% in the second quarter to 33.7%, while interest in secondhand homes rose from 8.3% to 10%.

Single detached houses were the most desirable category of property (40.4%), particularly those priced between 3.01-5 million baht. Condos followed (34%), with the majority priced between 2.01-3 million baht.

Townhouses accounted for 20.6% of interest among prospective buyers, mostly in the 2.01-3 million baht range. Semi-detached homes had the smallest share (4.8%), with most buyers targeting units priced between 3.01-5 million baht.

AUTHOR:

All copyrights for this article, including images, are reserved to the original source and/or creator(s).